Biden-Harris Student Debt Relief Plan

SHC class of 2022 celebrate graduation outside of the Cathedral.

As a college student prepares to begin the next chapter of their life, they often are plagued by the financial burdens that come along with higher education. The Biden-Harris Administration and the U.S. Department of Education addressed these worries on August 24, 2022, announcing a student debt relief plan. According to the plan, a student with debt may receive up to $20,000 as a Pell Grant student (a low-income individual helped financially by the government in paying college expenses), and up to $10,000 as a non-Pell Grant student. Through this plan, President Biden and his administration hope to forgive billions of dollars in loans to help people of all ages all over the nation. But what exactly does this entail for those applying for aid and why was it enacted in the first place? What questions have arisen from it, and who are its critics?

First off, this will be the final extension of pandemic debt relief, scheduled through December 31, 2022. Payments will begin again in January 2023. The new program is available to individuals with an income below $125,000, or $250,000 for households, extending to millions of lower to middle-class individuals and families. People are encouraged by the U.S. Department of Education to apply before the payment pause from this year expires on December 31, 2022, in order to receive loan forgiveness at the start of the next year. However, applications will continue to be accepted until December 31, 2023. Those who have student loan debt and are within the specified income group are encouraged to apply, though around 8 million people, according to the U.S. Department of Education, need not apply. The individuals’ data has been recorded and aid will be given unless they opt out. For the application, go to https://studentaid.gov/debt-relief/application.

So what is the purpose behind President Biden’s plan? This plan was enacted to ensure that people whose lives were devastated by COVID-19 could ease back into life without the government’s pandemic-era financial support, which is slowly coming to an end. Loan forgiveness would not only help families and college students financially but also allow them to pursue a brighter future. However, because the relief plan is focused on easing transitions, much of it is devoted to figuring out ways to make the system more manageable for current and future student loan borrowers. This would entail the implementation of a new rule presented by the Biden-Harris Administration, which would help decrease the monthly payments for lower to middle-class citizens. According to the Federal Student Aid website, there are four main points to this rule.

First, borrowers would only have to pay 5 percent or less of their monthly discretionary income (the amount of income left over after taxes and all living expenses are paid) for undergraduate student loans.

Second, the amount of income considered non-discretionary would be raised so that many people would not have to make their monthly payments. In other words, borrowers whose income is under 225% of the federal poverty level would not have to pay.

Third, loan balances would be forgiven after 10 years of payments, rather than 20, if they are $12,000 or less.

Lastly, it would cover borrowers’ monthly interest that they have not paid, ensuring that while they are paying off their loans, the balance will not increase.

All of this is part of the rule that would allow for a smooth transition after the end of the student debt relief plan. The government is continuing to work towards this goal to assist as many people as possible in increasing the affordability of receiving a good education.

With such a complicated and ambitious plan, people are bound to have many questions and doubts. For detailed information, including a full description of the Public Service Loan Program (PSLF), timelines, student loan pauses and conditions, the Emerald would like to point readers to the Federal Student Aid and NPR websites’ Q&As.

The plan also has its fair share of critics. On October 19, 2022, a Wisconsin taxpayer group known as the Brown County Taxpayers Association filed an appeal to “temporarily block the program’s implementation,” but only a day later, Associate Justice Amy Coney Barrett denied it. The next week, six conservative states —Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina— banded together to, once again, try to hinder the program. Their reasoning involves the idea that the plan would bypass congressional authority and negatively affect the tax revenue and money earned by state organizations whose business involves student loans. At first, they turned to a federal judge in Missouri to act upon their request, which was denied because of their failure to provide sufficient reasoning. Following their federal suit, the states then went to the United States Court of Appeals for the Eighth Circuit, which accepted their request on October 24, 2022, temporarily blocking the discharge of student loans. It is unclear how long this block will last as more of the states’ arguments are processed by the government, but applications are not open currently and will potentially be back and running again soon. Many critics cite the fact that it is set to be paid for by taxpayers through an average increased amount of $2,500 per person. For now, the Biden administration is working on an attempt to refute such negative accusations and build credibility for its efforts to help those with debt currently in need of aid.

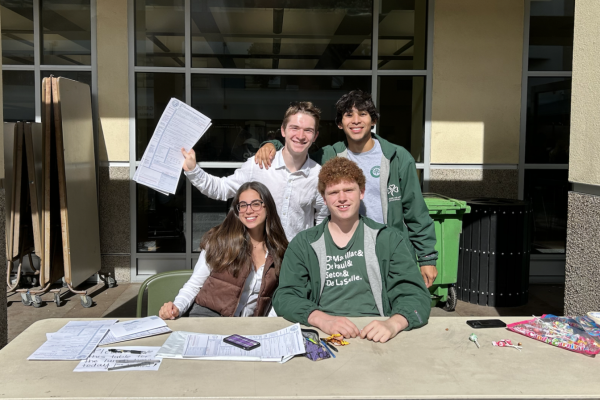

The Emerald asked some questions to SHC students for their own opinions. How can it impact current high school students looking for financial aid in their search for prospective colleges? How does it affect current or out-of-college individuals with debt? Jonah Lei ‘25 reflects on the benefits of the plan because of “ lowered costs” and notes that “college shouldn’t be so expensive.” His view points out the main reason why this plan is relevant currently to college expenses. Kaylyn Lee ‘24 shares, “I don’t know much about this debt relief plan” but agrees that “it helps people with college debt.”

SHC teachers also have thoughts on the matter. Dr. Harrison, an instructor of religious studies at SHC, shares a unique stance on the questions at hand. She believes that “This bill would have no impact on current high school students…It is aimed [at] people who have gone through college and accumulated debt.” As for college students or out-of-college individuals, she believes it would “reduce[…] their monthly payment or the duration that they would need to pay off their loans and […] help them significantly. […] It gives them financial freedom that they might not otherwise have.” The financial freedom she speaks of would definitely allow for more flexibility for borrowers’ other expenses such as housing, food, and medical needs. Ms. Bernard, Instructor of Social Studies and French at SHC, shares her stance: “When you look at the amount of money that you need to pay for college, it seems like a job [does not provide] a lot of money. I guess it is a small relief, but in the great scheme of things…they ought to think about reforms for college in general so that they don’t cost so much money that people are in debt for years to come.” Even within our own SHC community, opinions vary, but the main idea of them is that the plan would help many in some way with its widespread benefits.

The Biden-Harris Student Debt Relief Plan is a significant measure to help college students and graduates who have accumulated debt from the many expenses needed to afford education today. While it provides a smaller fraction of the relief needed, its incalculable benefit reveals its necessity for many low to middle-class individuals and families all around the United States. The plan not only allows people to feel comfortable knowing that a substantial amount of debt is being forgiven but also a sense of manageability as they transition back into regular life after the COVID-19 pandemic. With a lot of effort and much-needed relief, this will hopefully be the first step toward the goal of affordable and quality education for all.

After three years on the Emerald team as a writer, opinion editor, and head copy editor, Samantha is incredibly excited to serve as the Editor-in-Chief...